MinimiseTax

Minimising tax is key to wealth creation and retirement planning. The less tax we pay, the longer your funds will last & the more money ultimately for your beneficiaries too.

Our Client Results

Peace of Mind

Gain Confidence

Create Wealth to Enjoy

The Challenge

Read More

- Aged 50+ and investing,

- Aged 60+ and changing jobs,

- Aged 65+,

- Before aged 75,

- Selling your home, property or business,

- Your super balance is under $500K,

- There is an age gap with your partner,

- 4 R’s: Resigning, Retiring, Reducing hours or being Retrenched,

- Potential ‘death tax’ is significant,

- Contributing to superannuation,

- You know someone who doesn’t have long to live,

- Capitals gains tax to pay,

- Claim up to a $137,500 tax deduction,

- Paying too much tax,

- Wanting to invest tax free (0%),

- Received a Division 293 tax notice,

- I’m having to pay tax regularly for my SMSF.

- I have a Family trust.

And More

Descending tax rate model

Please find a simple list of a few taxes to minimise in descending order. Our advisors can explain the relevant taxes, as well as the recommended strategies to minimise these taxes for you.

Up To66%Income Tax For Kids

The tax rate for children’s investment income is very high to discourage moving assets into children’s names.

Up To45%Income Tax

In Australia, the more you earn, the higher the percentage of tax, capping at a large 45%.

There is a tax free (0%) threshold if income is under $18,200 & this can be overlooked in retirement planning.

Up To32%Death Tax

Up To30%Company Tax

Up To24.5%*Capital gains tax

*Maximum rate of CGT and actual tax rate may be lower

Up To15%Superannuation

Superannuation has a tax rate of 15% on:

- Investment income

- Contributions – from an employer, salary sacrifice or where a tax deduction is claimed.

In both scenarios, 15% is often a lower tax rate than investing personally where the tax rate could be up to 45%.

Additional15%Div 293

Div 293 tax is an additional tax on superannuation contributions if your income exceeds $250,000.

Up To2%Medicare Levy

The Medicare levy is 2% of your taxable income and you may receive a reduction or exemption, depending on your circumstances.

Up To0%Super income phase

It is a great opportunity to access a legal tax rate of 0% on investment income and withdrawals.

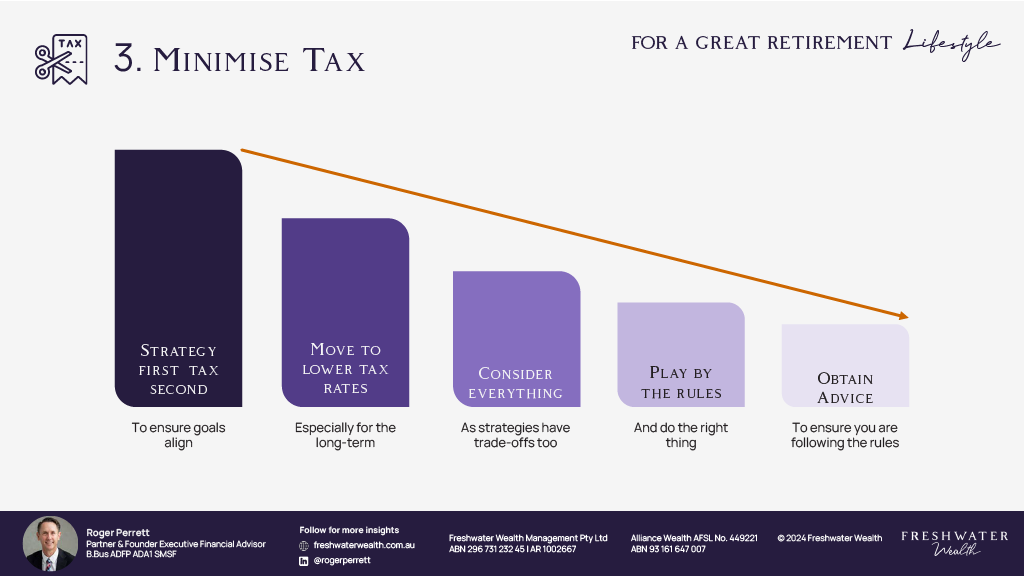

Our 5 Principles for Minimising Tax

The good news is that our advisors can create a strategy to achieve your goals, as well as minimise some of these tax’s.

1. Strategy first, tax second

The strategies we recommend often have secondary benefit of reducing tax.

2. Move to lower tax rates

Generally we need to shift from paying 45%, to 0% in retirement. The legislation means this can take time, so we should start early.

3. Consider everything

Often a tax saving can have other restrictions that should be considered. It is often best to be wary of implementing a strategy just for a tax benefit.

4. Play by the rules

Our strategies consider tax & in many cases save you considerably money. However, we will never suggest breaking the rules.

5. Obtain advice

Where specific tax advice is required; we can recommend tax advisors or accountants.

Peace of Mind

Have peace of mind with complexity removed.

Gain Confidence

Gain confidence with personalised strategies.

Enjoy Life

Create wealth to enjoy.

For A Great Retirement Lifestyle

We believe

We believe that we should complete forms (where possible) as our customer’s time is valuable.

Download Our descending tax Methodology

Learn effective strategies to minimise tax and maximise your wealth for a more prosperous retirement.

What Our Clients Say

Merran, 46 - 55 years, Spencer, NSW

Read More

Margaret, Alexandria, NSW, 55+

Read More

Joe, 56 - 65 years, Castle Hill, NSW

Read More

Phil, 56 - 65 years, Narraweena, NSW

Lisa, 56 - 65 years, Rose Bay, NSW

Read More

Vanessa, 56 - 65 years, Balgowlah Heights, NSW

Read More

Patricia, 65+ years, Hornsby, NSW

Read More

Vivienne, 65+ years, Leura, NSW

Read More

Mark, 56 - 65 years, Balmain, NSW

Read More

Jo, 46 - 55 years, Freshwater, NSW

Read More

Kathleen, 56 - 65 years, Bundanoon, NSW

Read More

Paul, 56 - 65 years, Balgowlah Heights, NSW

Graydon, 65+ years, Narrabeen, NSW

Read More

Terry, 56 - 65 years, Balmain, NSW

Read More

Carmen, Beverly Hills, NSW, 45+

Read More

Bruce, Crows Nest NSW, 65+

Read More

John, Epping, NSW , 65+ years

Read More

Robert, Port Macquarie, NSW , 65+ years old

Read More

David, Kellyville, NSW , 65+ years old

Read More

Let's Get Started

Claim the opportunity to meet our expert Financial Advisors, at no cost to you. Gain clarity on goals, get an action plan, and see how we can support your financial dreams.