InvestmentAdvice

Gain confidence in your investments & superannuation, knowing you’ll have strong performance that allows you to rest easy at night.

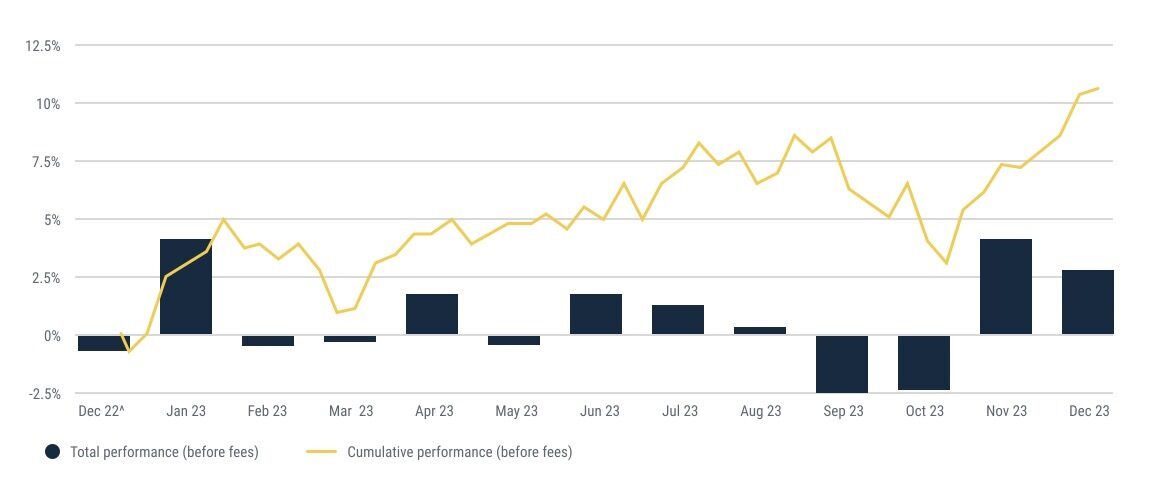

Our Client Results

Peace of Mind

Gain Confidence

Create Wealth to Enjoy

Neil & Rebecca invested the proceeds from the sale of their business & funded their retirement lifestyle.

Investment uncertainty

Making money through investments can be complex and challenging. Emotions frequently lead us astray from sound practices, urging us to buy during market highs and sell during downturns.

It can also be easy to unknowingly hold onto underperforming superannuation and investments. With a ‘set and forget approach’ you may realise years later that you could have had so much more.

Our investment advice is based on:

Performance Or Lifestyle Goals

Investment Principles

Investment Research

Your Risk Comfort level

Determining Your Risk Comfort Level

We have a simple process to determine the level of investment return you are seeking, your risk comfort level, as well as your investment experience and timeframe.

We then describe in detail on how your investment portfolio is likely to behave and perform, so you feel totally comfortable before investing.

This image is an example only and does not necessarily represent actual or likely returns for an investor.

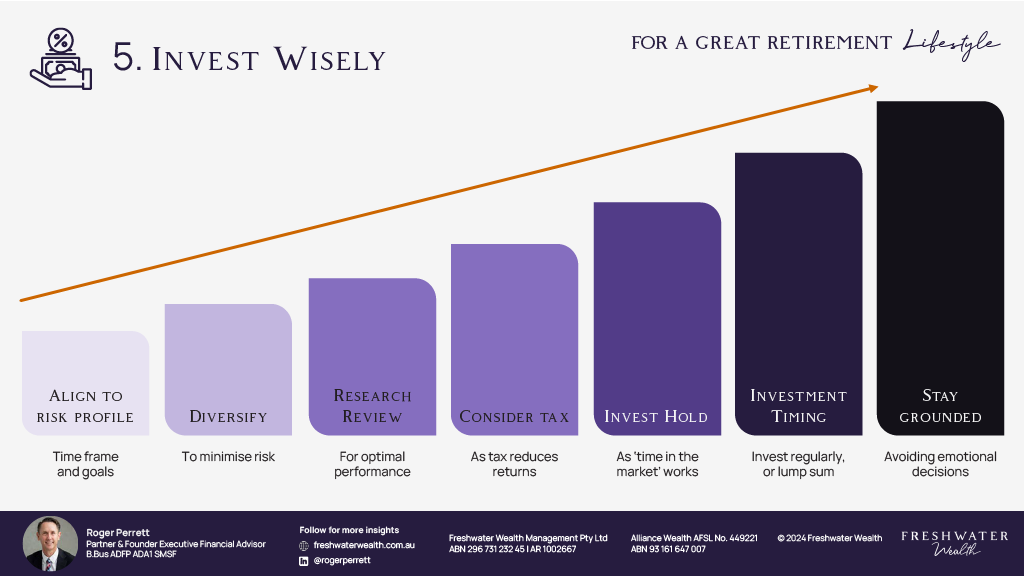

Investing Principles

Using the insights from your risk comfort level we consider many investment principles including:

- Align investments to your risk profile

- Diversify investments

- Research and Review

- Consider Tax Consequences

- Invest and Hold Strategy

- Market Timing

- Stay Grounded

Investment Research

We access an unparalleled breadth and depth of qualitative research. This research allows us to provide you a best-of-breed approach, to world class investment managers. When creating an investment portfolio, we consider:

- ETF’s & Index funds

- Active Funds

- Separately Managed Accounts (SMA’s)

- Managed Discretionary Accounts

- Wholesale Investments

- Term deposits

- Asset Allocation

Non-Bias Research

To assist us in managing the asset allocation and investment selection, we use independent research, so there is no bias or conflict of interest. We obtain investment research from Centerpoint Alliance, Morningstar and Lonsec.

Talk to A Financial Advisor Today

Ready to start your journey with Freshwater Wealth? Contact our friendly team and arrange a meeting to discuss your future.

Investment Asset Classes

At Freshwater Wealth, our investment strategy considers a broad range of asset classes to diversify your portfolio. We focus on:

• Australian Shares

• International shares

• Property

• Fixed Income

• Cash

• Alternatives

Download Our Invest Wisely Infographic

Visualise and plan for key aspects of your life.

Peace of Mind

Have peace of mind with complexity removed.

Gain Confidence

Gain confidence with personalised strategies.

Enjoy Life

Create wealth to enjoy.

For A Great Retirement Lifestyle

Merran, 46 - 55 years, Spencer, NSW

Read More

Margaret, Alexandria, NSW, 55+

Read More

Joe, 56 - 65 years, Castle Hill, NSW

Read More

Phil, 56 - 65 years, Narraweena, NSW

Lisa, 56 - 65 years, Rose Bay, NSW

Read More

Vanessa, 56 - 65 years, Balgowlah Heights, NSW

Read More

Patricia, 65+ years, Hornsby, NSW

Read More

Vivienne, 65+ years, Leura, NSW

Read More

Mark, 56 - 65 years, Balmain, NSW

Read More

Jo, 46 - 55 years, Freshwater, NSW

Read More

Kathleen, 56 - 65 years, Bundanoon, NSW

Read More

Paul, 56 - 65 years, Balgowlah Heights, NSW

Graydon, 65+ years, Narrabeen, NSW

Read More

Terry, 56 - 65 years, Balmain, NSW

Read More

Carmen, Beverly Hills, NSW, 45+

Read More

Bruce, Crows Nest NSW, 65+

Read More

John, Epping, NSW , 65+ years

Read More

Robert, Port Macquarie, NSW , 65+ years old

Read More

David, Kellyville, NSW , 65+ years old